Instructions for the first home owner grant for approved agents

These instructions are for approved agents who lodge and process first home owner grant (FHOG) applications.

The FHOG approved agent user guide provides detailed information for authorised agents on:

- FHOG eligibility

- user roles in fhogOnline

- lodging applications

- uploading attachments

- changing an applicant to a non-applicant

- searching for an application

- status reporting

- cancelling, suspending and reactivating applications

- flagging applications for audit

- viewing application history

- returning the grant to Queensland Revenue Office (QRO).

All applicants and transactions must meet the following criteria to be eligible for the grant.

1. Eligible applicant

- All applicants and their spouses must not have owned a home before 1 July 2000.

- All applicants and their spouses must not have owned a home on or after 1 July 2000 in which they have also resided.

- All applicants and their spouses must not have previously received the grant.

- When applying for the grant, at least one applicant must be an Australian citizen or a permanent resident (includes holders of a special category visa).

- All applicants must be 18 years or more at commencement of the eligible transaction.

- All applicants must be natural persons, not trustees or companies.

- All applicants must occupy the home as their principal place of residence for a continuous period of at least 6 months commencing within 12 months of completion of the eligible transaction.

2. Eligible transaction

- Applicants must enter into an eligible transaction to buy or build a new home, or build a new home as an owner–builder.

- Contracts to buy or build a new home must have been signed on or after 1 July 2000 and be for a home:

- as defined under the First Home Owner Grant and Other Home Owner Grants Act 2000

- as outlined in practice direction FHOGA000.1—Meaning of ‘home’, ‘new home’ and ‘residential property’.

- A cap amount of $749,999.99 applies to transactions entered into on or after 12 September 2012 for buying or building a new home. Applicants who buy or build a new home that is worth $750,000 or more (including contract variations) will not be eligible for the grant.

Read more about the Queensland First Home Owners’ Grant.

The FHOG application forms for each jurisdiction can be printed from the state revenue office (SRO) website in each state or territory. Download the Queensland application form and the owner-builder cost summary annexure from Queensland Publications.

Scanned application forms

You can accept scanned applications from your clients. The scanned documents must be:

- complete

- signed

- clearly legible.

You must confirm your client’s identity before accepting scanned applications.

Electronic signatures

Version 5 of the application form allows applicants and non-applicant spouses to agree to and sign the declaration electronically (e.g. Adobe Digital ID).

![]()

Signatures do not need to be witnessed.

Electronic signatures that can be easily manipulated or signed by someone other than the applicant—such as email signatures, pictures or scanned signatures—will not be accepted.

Supporting documents

The application form has a list of the required supporting documents on pages 12 to 15.

Your client must provide all supporting documents when applying for the grant. You must assess these documents when submitting the application in order for it to be considered complete.

You must endeavour to ensure all persons shown as applicants are eligible for the grant based on the supporting evidence. We may ask you to produce this evidence.

Documents do not need to be certified.

Expired passports

From 21 January 2022, approved agents are authorised to accept expired passports for the grant in the limited circumstances described below.

Expired Australian passports

You can accept an expired Australian passport as part of the identification documents where both these requirements are met.

- The expired passport was issued:

- when the applicant was 16 or older

- with at least a 2-year validity

- on or after 1 January 2006.

- The applicant or non-applicant spouse has provided a current category 2 photo ID with their application.

If the expired passport is not in the applicant’s or non-applicant spouse’s current name, you must obtain evidence of a name change to confirm the identify. The passport will not be accepted if the name-change evidence does not confirm the name on the passport.

Expired international passports

Where an expired international passports is submitted as part of the identification documents, approved agents must seek approval from QRO before accepting the documents and only where all the following requirements are met:

- The expired passport was issued:

- when the applicant was 16 or older

- with at least a 2-year validity

- in the applicant’s current name, date of birth, place of birth and gender.

- The applicant or non-applicant spouse has provided a current category 2 photo ID with their application.

- The applicant’s or non-applicant’s spouse’s visa has been verified using the Document Verification System (DVS) or Visa Entitlement Verification Online (VEVO)—national databases managed by the Department of Home Affairs.

- You have received approval to accept the expired international passport from Queensland Revenue Office.

To seek approval to accept an expired international passport, you must:

- Email FHOGadmin@treasury.qld.gov.au requesting the acceptance of an expired passport, with the applicant’s full name and application UIN.

- Provide a copy of the following documents by email or uploaded to FHOGonline:

- visa

- current category 2 photo ID

- evidence of a name change (if necessary)

- expired passport that fits the above criteria.

If an applicant’s visa cannot be verified, the expired passport will not be accepted and another form of current category 1 ID is required. We will confirm by reply email if the expired passport has been accepted or refused.

An expired international passport will not be accepted if:

- the passport is not in the applicant’s or non-applicant spouse’s current name and the name-change evidence does not verify the name on the passport

- an applicant’s or non-applicant spouse’s visa cannot be verified via DVS or VEVO.

Signing the application form

You are responsible for ensuring that declarations are signed by applicants and their spouses correctly. You also need to ensure (as far as possible) that all interested persons are included in the application before it can be considered complete.

The application form must not be signed before the contract date. If it is, the application is void and cannot be processed.

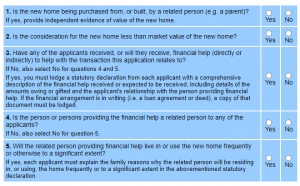

The addendum is part of general anti-avoidance provisions enacted in Queensland to prevent misuse of the scheme and applies to all applications.

Disqualifying arrangements

All applicants must complete the addendum section of the application form under section 2 ‘Applicant details—Disqualifying arrangements’ before an application for the grant can be processed.

Data entry

Ensure that all data entered into fhogOnline is correct before lodging. Pre-compliance checks rely on the accuracy of the data entered. Any incorrect data may result in an ineligible application.

Penalties may be imposed if a grant is to be repaid to QRO.

Ensure the Street name is entered in full; for example, First Avenue not First Ave.

If the Address for notices is a PO Box (or similar), enter the address in the Street name field. (Leave the Unit/street no. field blank.)

Record keeping

You must keep all information used in determining an application for a minimum of 5 years.

From 8 July 2021, you no longer need to keep paper records. That is, applications and supporting documents may be kept as electronic records only.

The grant can be returned by electronic funds transfer (EFT). When returning the grant, you must add a note into fhogOnline explaining the circumstances.

When this is complete, email fhogpayments@treasury.qld.gov.au and include the:

- UIN

- applicant’s name

- date returned

- reason for returning the grant.

Funds should not be held for more than 28 days. If settlement has not occurred by 28 days from the original settlement or payment eligibility date, you must return the grant unless an extension has been requested and granted. (Refer to ‘Extension to hold grant’ in the user guide.)

The grant must be returned if the:

- settlement has been deferred

- applicant is no longer proceeding through your organisation

- loan is not proceeding.

The payment eligibility date should be monitored to ensure payment is not made unnecessarily. For example, if the applicant withdraws their application or their loan is declined, cancel the application (or ask us to do so).

Cancelling the application stops the grant payment from being made. (Refer to ‘Cancelling an application’ in the user guide.)

The grant can be returned by electronic funds transfer (EFT). When returning the grant, you must add a note into fhogOnline explaining the circumstances.

When this is complete, email fhogpayments@treasury.qld.gov.au and include the:

- UIN

- applicant’s name

- date returned

- reason for returning the grant.

Funds should not be held for more than 28 days. If settlement has not occurred by 28 days from the original settlement or payment eligibility date, you must return the grant unless an extension has been requested and granted. (Refer to ‘Extension to hold grant’ in the user guide.)

The grant must be returned if the:

- settlement has been deferred

- applicant is no longer proceeding through your organisation

- loan is not proceeding.

The payment eligibility date should be monitored to ensure payment is not made unnecessarily. For example, if the applicant withdraws their application or their loan is declined, cancel the application (or ask us to do so).

Cancelling the application stops the grant payment from being made. (Refer to ‘Cancelling an application’ in the user guide.)